Oil Price Chaos Continues After Record Crude Production Plunge, Major Gasoline Draw

Oil Price Chaos Continues After Record Crude Production Plunge, Major Gasoline Draw

Oil prices have swung wildly this morning ahead of the official inventory data following reports that China will release some of its strategic crude reserves.

In a late announcement on Thursday, Beijing said it had tapped its giant oil reserves to "to ease the pressure of rising raw material prices." The Chinese government didn't offer further details, but people familiar with the matter said the statement referred to millions of barrels the government offered in mid-July.

“On its face, it’s a pretty clear statement of an intent to use the SPR to dampen oil prices for domestic refiners,” said Bob McNally, a former senior White House policy adviser who now runs Rapidan Energy Group, a consulting firm in Washington.

For now, the algos will be focused on the inventory data for signs of Delta's impact... but perhaps it is Ida's impact that will confound most.

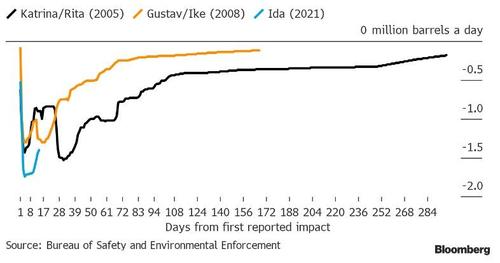

Hurricane Ida may not have been the deadliest or most damaging weather system ever to smash into the U.S., but its initial impact on Gulf of Mexico oil supply has been greater than any other storm in history.

Ida has been responsible for the loss of 20.7 million barrels of output in the 13 days since the Bureau of Safety and Environmental Enforcement issued its first assessment of production shut-ins as a result of the storm. That’s 40% more crude than was lost to Katrina over the same period in 2005.

API

Crude -2.882mm (-3.8mm exp)

Cushing +1.794mm

Gasoline +6.414mm (-3.6mm exp)

Distillates -3.748mm (-3.0mm exp)

DOE

Crude -1.528 (-3.8mm exp)

Cushing +1.918mm

Gasoline -7.215mm (-3.6mm exp)

Distillates -3.141mm (-3.0mm exp)

API reported a smaller than expected crude draw and wholly unexpected gasoline build last week but the official data showed an even smaller crude draw but a huge gasoline draw

Source: Bloomberg

Rig counts dropped last week, likely impacted by Ida's imminent arrival but production crashed by a record 1.5mm barrels/day...

Source: Bloomberg

Currently only 20% of the offshore platforms are still evacuated, but 77% of oil production remains shut-in. One of the drivers behind the slow return of oil and gas has been Louisiana’s Port Fourchon -- a key hub for oil and gas platforms handling more than 18% of its entire oil supply. As of Sept. 7, work to restore operations at the port is still ongoing.

A chaotic morning in crude saw WTI plunge to a $67 handle only to rip back up near a $70 handle ahead of the official DOE data, and dipped a little after...

“The move by China is no doubt designed to ease upward price pressures on rising oil import costs,” said Ryan Fitzmaurice, commodities strategist at Rabobank.

“It is unlikely to have the desired effect, as we see it. For starters, it signals vulnerability to the financial oil market, and even more so it is not enough physical supply to move the dial.”

Comentarios

Publicar un comentario